No posts found!

Finally you have made it to the right place, stop loosing money and use proper penny stock trade methods. We have already been through the losses and have developed the proper penny trading methods, we are going to pass these on to you to help reduce your risk. I want to formally Welcome you to Penny Stock Spy your premium newsletter that well get you the max money for your trade without looking back, get your millions from our alerts and show off to your friends, what type of cash roll they too can have. Simply Trade Penny Stocks and get your feet wet. We don't play games at spy we give you the best penny stocks to buy with super quality alerts with max profits to fill your pockets with day trades that are made not found. Every time you play a popular top stocks to chances are it is running on news or buzz so why not start the buzz and make money finder with massive profits and head turning to track record and get alerts in your email the way you want it not the way we want it high quality alerts inbox with day trading options With our aggressive research we pin point stocks day trading you can buy to profit

Best Penny Stocks To Buy |

Chat History |

Investing In The Stock Market |

Content Glossary |

Most Watched Penny Stocks

penny stocks to buy you the tools and ability that you can day trade for max profit alerts and day trading potential with huge money at hand easier and make huge market profits and send out an alert that 9 out of 10 subscribers make money giving them the best ability to reinvest. The bigger your portfolio the more you can spread your risk with penny stocks. With

stocks we are able to pin point potential daily stocks runners before any otherwe are going to send you the best penny stocks trades daily giving you the best smoking mega movers called Hot Penny Stocks To Watch that can bring massive profits giving the best trade tips to help you make profits, no more waiting around for a slow return. Don't hold back join now and start making real profits and become a pro trader.

sites Our subscription is free and we make sure our followers are happy with our penny stocks and with our state of the art tools and day trading alerts we bring you the most advanced picks wall street has seen, hurry and max out your profit margins today and create a heavy cash flow for yourself Hot penny stocks Alerts Bottom line is we bring you mega money with day trading profits and a high rate of return that well fully satisfy your needs if we don't keep our stocks customers happy we loose them We are here to gain customers and keep a long term relationship Day Trading the best smoking Hot Awesome Penny Stocks around that bring massive gains while being a contact sport and needs strong team work we can find the top 10 and money makers for day traders and swing traders who want a way for new cars and new homes with none stop cash flow It takes dedication and advanced Watch research to find the primed top 10 fast moving best buying on the rise great plays of the day heading up for gains become rich. We email quality alerts with mega potential for profits Our team is assembled including advanced top level Wall Street traders Join free and get our next Hot Alert. Get quality prices before anyone else for huge profits, the key to trading is knowing before anyone else so you can make the most profit before any other traders that are going to follow after you, you buy them and strap your seat built for huge gains coming your way get ready for what can make you the millionaire you have wanted to be with none stop cash flow and fancy cars with huge houses and advanced trading tools and education. We have been trading for over 6 years and buy and short stocks. Our experience pushes us forward to be one of the best penny stocks buyers around. Our advice has been proven over and over again with our stocks picks.

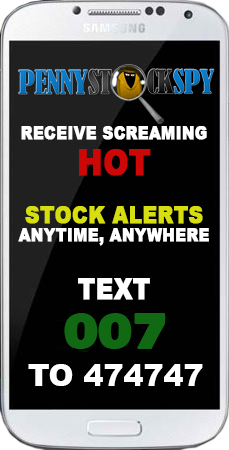

Get HOT ALERTS on the go with our FREE SMS Alert service.

Disclaimer: SMS/Text Message charges subject to your cellphone providers fees. Please check with your cellphone plan provider for details and pricing. Alerts are issued as opinion and should no be used as guides for when to trade stock. OTC Fire is not a licensed financial adviser. Please consult with your licensed financial adviser before trading stocks.